Reconocimientos

-

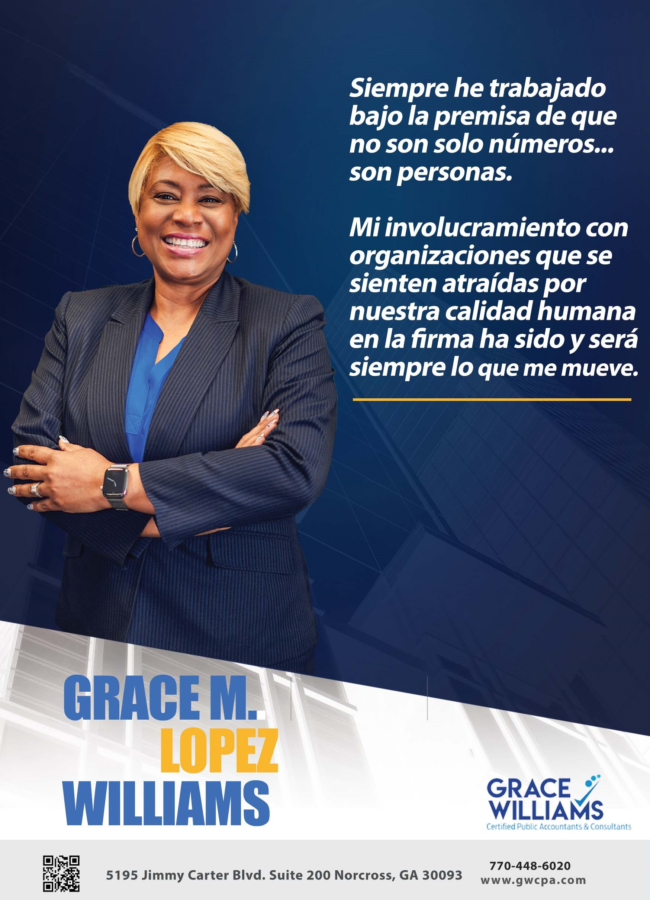

Grace Williams fue elegida una de las 100 mujeres de negocios más influyentes de Atlanta por la organización Women Looking Ahead.

-

También es Presidenta y Fundadora de la Junta Directivadel Capítulo de Atlanta de la Sociedad Nacional de MBA Hispanos.

-

La revista Hispanic Business seleccionó a Williams entre los 100 hispanos más influyentes en los Estados Unidos

Certificaciones Profesionales

PFS Personal Financial Specialist, Series 6, 63 & 65

CTRS Certified Tax Resolution Specialist

CPA Certified Public Accountant

MBA Business from Loyola University in New Orleans

BBA Accounting from the University of Puerto Rico

Honors and Awards

- 2018- Present Founder Trabajo Legal USA LLC and Zeta Workforce- Inc

- 2017- Present Founder GM International Consultants, LLC

- 2016- Present Access to Capital for Entrepreneurs, Treasurer

- 2013-2015 Boy Scout of America, Executive Board Member

- 2012 Business Series Latina Style Entrepreneur of the Year

- 2012 Enterprising Woman of the Year

- 2011 Board Member of Girl Scouts of America

- 2011 LACE Award-Ladies Achieving Continuous Excellence

- 2010 MABC Business Woman of the Year

- 2010 Habla Entrepreneur of the Year

- 2009 Leadership Atlanta Class 2009

- 2009 Certified Tax Resolution Specialist Company

- 2008 South Carolina YMCA Dreamer Achiever Award

- 2008 Nobel Women Pioneer Award

- 2007-2008 Founder Board Member of Ivy Preparatory School

- 2006-2009 Founder Board Member of Sunrise Bank in Atlanta

- 2005 Result Counts Award by Georgia Women Entrepreneurs

- 2004-2007 Board Member of the Gwinnett Chamber of Commerce

- 2004-2011 Board Member of the Georgia Board of Accountancy

- 2004-2011 Member of the National Association of State Board of Accountancy

- 2003-2004 President National Society of Hispanics MBA- Atlanta Chapter

- 2001-2002 Executive Vice President National Society of Hispanics MBA-Atlanta

- 2000 The 100 Most Influential Hispanics in United States

2000-2001 Treasurer for National Society of Hispanic MBA

Grace M. Lopez-Williams tiene experiencia en ayudar a las empresas con la reestructuración de sus funciones financieras para que respondanmejor a las necesidades operativas de sus clientes finales, almismo tiempo que reducen costos y mejoran el tiempo de respuestautilizando la automatización.